It’s shopping season: “Black Friday” has just wrapped up and now comes Christmas, followed by the January sales.

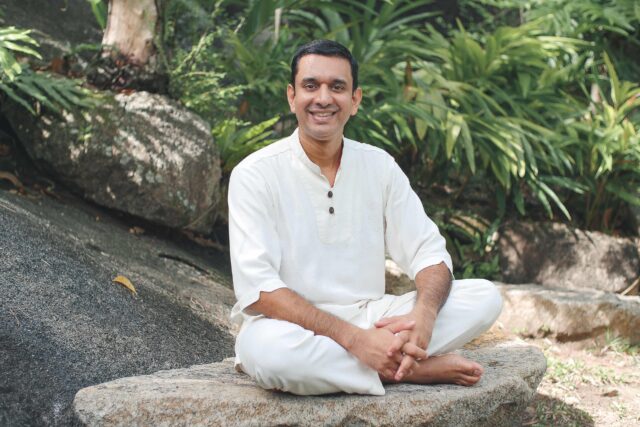

For those with a shopping addiction, it’s a tough time. A leading UAE behavioural therapist is encouraging them to develop strategies to cope with the hype created by all that constant advertising that’s everywhere around us, from television to social media.

“All rationale and reasoning around over-spending gets overlooked in favor of the short-term gain, despite the common, longer-term consequences such as anxiety, depression and debt,” says Mandeep Jassal, from Priory Wellbeing Centre, Dubai.

Compulsive Shopping Disorder (CBD) is characterized by excessive shopping and thinking about more purchasing, which leads to distress and can bring about a negative impact on many levels, including financially and where relationships are concerned. CBD is usually a way of dealing with negative emotions and often masks mental health issues such as depression, anxiety, obsessive compulsive disorder and low self-esteem.

Research published in the journal of Comprehensive Psychiatry suggests the inability to control spending impulses should be taken far more seriously than it is currently. “Shopping addiction or CBD should be treated no less seriously than other addictions, such as alcohol or substance abuse. Indeed, shopping addiction can often develop as a means of filling the void left when other addictions are overcome,” says Jassal.

“However, while most addictions require complete abstinence, treatment for shopping addiction is different. Recovery from an addiction to shopping doesn’t mean never shopping again, but it does mean establishing a long-term plan and commitment to refrain from addictive patterns. This is crucial to ensuring events such as Black Friday are merely triggers that can be effectively managed.”

Jassal recommends the following temporary recovery solutions:

- Make a schedule of other activities you will undertake while limiting or excluding your shopping time and purchases

- Remove shopping apps from all your electronic devices

- Practice mindfulness – whether breathing exercises, a mindful walk or mindfully engaging when your children play – to gently focus your attention on the present moment

- Challenge any negative, unhelpful thoughts by considering what you would say to a close family or friend going through the same thing

- Use your support network to talk through your feelings and seek professional support if the problem is taking over your life

- Put aside money in a glass jar that you would typically spend on shopping. Watch this money ‘grow’ and be a visible reminder of what you are overcoming each day. Use this money at the end of the month on an activity you have always wanted to do or save it toward something important.

Longer term, Jassal says it is important to understand what is actually driving the behaviour.

“Was there a recent loss? Have you been under excessive pressure? Have you lost your sense of direction and purpose in life? Once we explore this, then it will be easier to develop more helpful behaviours with less resistance as you will have a conscious understanding of your unhelpful patterns.”

With the run up to the festive season and the following associated sales also on the horizon, Jassal believes this can be one of the most challenging times of the year for those with CBD.

“The festive season is, for many, a time for ‘giving’ and connecting with loved ones. Given the challenging times we’re going though with the ongoing pandemic and the inability to visit loved ones and spend quality time together, buying things as a way of showing love and affection may increase, especially for those with a CBD.”

Debt often goes hand-in-hand with a shopping addiction and studies show that individuals with depression and anxiety are three times more likely to be in debt.

“The more debt they have, the greater their anxiety. The thought that they can’t buy things increases the likelihood of them going shopping.”

The stress that can result from being in debt can be hugely detrimental to our mental and physical health. This can be particularly common in the New Year, when credit card bills and bank statements arrive and the full repercussions of festive overspending can be felt. “Shame, embarrassment, failure, self-blame, and low self-esteem are all extremely common where debt is concerned and can go on to cause serious mental health conditions.

Jassal says that while recovery from any kind of addiction is hard, it is possible provided there is a complete and proactive change in thinking and attitude – and that takes time and requires professional support.

“Developing effective coping strategies, particularly at this time of year, to help develop restraint and encourage mental strength will enable us to take back control and ensure a positive emotional and physical balance.”

- The Priory Group is the leading provider of behavioral care in the UK, organised into four divisions – healthcare, education and children’s services, adult care and the Middle East.